Texas ESA Program: Breaking Down the New Proposed Rules

- Accessible Education

- Aug 26, 2025

- 13 min read

Updated: Nov 10, 2025

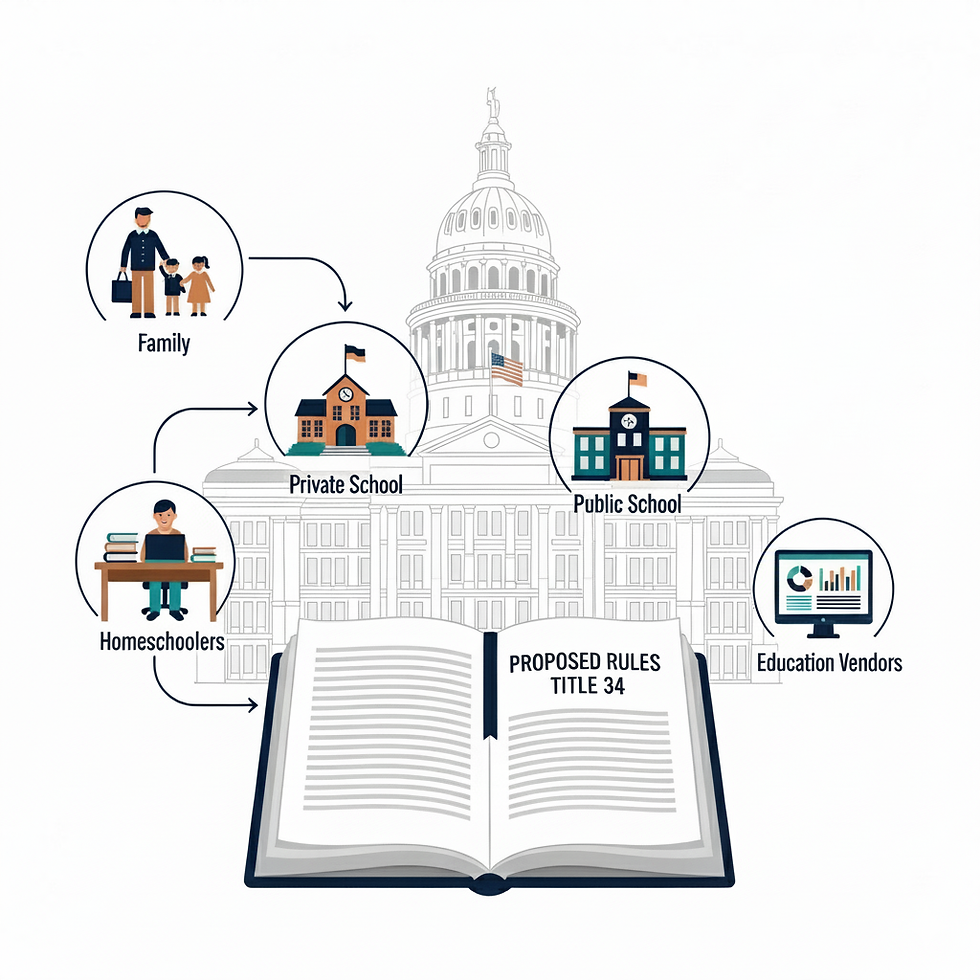

Introduction: Building on Our Previous Texas School Voucher Coverage

In our ongoing coverage of the Texas Education Savings Account (ESA) Program, we've systematically analyz

ed each new development as details have emerged. We began with a comprehensive breakdown of Senate Bill 2, using only the bill text as our source. We then examined the Comptroller's Request for Proposals (RFP) documents to understand the proposed timeline for the program rollout, drawing from the RFP itself, its addendum, and the Comptroller's official responses to questions from potential vendors.

On August 22, 2025, the Comptroller's office made a significant announcement: the proposed rules have been released, initiating a 30-day public comment period. Now, we're integrating our previous coverage with these newly released "Proposed Rules Title 34" to provide a complete picture of how the Texas ESA Program will operate.

If you'd like to jump directly to the section most relevant to you, use the guide below:

The Rulemaking Process and Timeline

The proposed rules follow a structured timeline that advances the program's implementation significantly. The rules for the Comptroller's Investment Advisory Board were filed with the Office of the Secretary of State on August 8, 2025, while the ESA Program rules were filed on August 11, 2025.

Both sets of proposed rules have an earliest possible adoption date of September 21, 2025, notably earlier than the May 15, 2026 deadline for rule adoption specified in Senate Bill 2. Following publication, a 30-day public comment period will be held, during which the Comptroller's office will review feedback, make revisions, and proceed toward final adoption.

Meanwhile, the RFP timeline has been accelerated. The contract execution date was moved up from October 16, 2025, to August 31, 2025 (or as soon thereafter as practical), with work commencement advancing from October 17, 2025, to September 1, 2025. Despite these accelerated administrative timelines, the program remains on track for families to apply beginning in early 2026, with the program launching for the 2026-27 school year.

Key Changes and Clarifications from Previous Sources

The proposed rules introduce several important modifications from what was outlined in Senate Bill 2 and the RFP documents:

Refund Destination: The proposed rules state refunds go to the child's account for future educational purchases, contradicting Senate Bill 2's requirement that recovered money go to the program fund.

Audit Frequency: Reduced from "not less than twice per year" (RFP) to "not less than once per year" (proposed rules), aligning with SB2's annual requirement.

$2,000 Funding Cap Expansion: Broadened from "home-schooled students" (SB2) to any child "not enrolled in a private school that is an approved education service provider."

Notification Timeline: Changed from 30 business days (SB2) to 30 calendar days for reporting child ineligibility.

Waitlist Expiration: Applications remaining on the waitlist at program year-end now expire and require reapplication (new requirement not in SB2 or RFP).

Detailed Stakeholder-Specific Information

Parents and Families

Understanding Key Terms That Affect Your Application

The proposed rules define several important terms that will directly impact your family's participation:

Total annual income: This refers to the total income for federal income tax purposes of the child's parents, or the qualifying parent if only one claims the child as a dependent. This definition will determine your family's priority category and funding eligibility.

Program year: The period runs from July 1 of one year through June 30 of the next year, which is important for understanding funding cycles and continuation requirements.

Sibling: The program expands this definition to include step-siblings and foster siblings who are dependents placed by an authorized agency or court order, potentially qualifying more children for first priority status.

Good standing: This means complying with all applicable program requirements and applicable law—a status that affects your ability to continue in the program and receive priority for the following year.

Application Requirements

Parents must submit a Comptroller-approved application during the designated application period, along with specific documentation:

Citizenship Verification: Provide a certified copy of your child's birth certificate, certificate of naturalization, U.S. passport, or Permanent Resident Card.

Texas Residency Verification: Submit a utility bill, lease/mortgage statement, driver's license/state ID, voter registration card, letter from a government agency, or notarized affidavit of residency.

Income Verification: Include an Internal Revenue Service transcript of a federal tax return to verify your total annual income for prioritization purposes.

For Children with Disabilities: Provide an SSI/SSDI determination letter, written diagnosis from licensed physician describing specific conditions, or authorization to verify an Individualized Education Program (IEP).

Required Parental Certifications (Under Penalty of Perjury)

Parents must certify that they will:

Only request program money for approved education-related expenses

Not attempt to withdraw cash or seek reimbursement from the child's account

Refrain from selling items purchased with program money within 12 months of purchase

Authorize and instruct the private school (grades 3-12) to provide assessment results to CEAO

Comply with all audit requirements

Provide written notification within 30 calendar days if the child enrolls in public school or becomes ineligible

Cease requesting distributions when the child becomes ineligible

Continuing Participation and Priority Categories

Annual Continuation: Families in good standing need only provide annual notice of intent to continue participation (no full reapplication required). Continuing participants receive priority admission for the following year, and unused funds carry forward to the next program year if the child remains eligible.

Application Prioritization Categories:

First priority: Siblings of participating children

Second priority: Children not previously enrolled in public school

Third priority: Children who previously ceased participation by enrolling in public school

Within each category, there are subcategories based on disability status and income levels relative to federal poverty guidelines. If applications exceed available slots within subcategories, a lottery system determines admission. The program limits funding to 20% for children in the highest income category (500% of federal poverty level).

Appeals Process

If your application is denied or you face an adverse decision:

Provide written notice of appeal to the Comptroller within 30 calendar days

Use the Comptroller-approved format

Include your child's name, brief statement of facts, and basis for overturning the decision

The Comptroller will respond within 30 calendar days with a final decision

The Comptroller's decision is not subject to further appeal

Consequences for Fraud

Families who submit false or fraudulent documentation face immediate program ineligibility and must reimburse the program for any improper purchases resulting from the fraudulent documentation.

Homeschoolers and Students Attending Non-ESA-Approved Private Schools

Understanding Your Funding Category

The proposed rules clarify that the $2,000 funding cap applies to any child "not enrolled in a private school that is an approved education service provider," not just traditional homeschoolers. This broader definition means that any family choosing to educate their child outside of an ESA-approved private school will receive this reduced funding amount.

Assessment Requirements for Homeschoolers

Unlike private school students, homeschooled children are explicitly excluded from the annual assessment requirement.

Approved Expenses for Homeschoolers and Students Attending Non-ESA-Approved Private Schools

Your $2,000 annual allocation can be used for:

Textbooks and other instructional materials

Assessment instrument costs

Private tutor or teaching service fees

Educational therapy fees (defined as treatment provided by or at the direction of a licensed physician or licensed therapist to address academic performance, but only if not covered by other benefits and not provided by public school)

Computer hardware, software, and technological devices (up to 10% of annual account allocation)

Important Restriction: You cannot use program money to pay relatives within the third degree by consanguinity or affinity.

Account Management

The CEAO must verify your child's continued eligibility before making funds available. All purchases must be made through the Comptroller-approved marketplace. If services aren't provided or products are returned, refunds are deposited back into your child's account for future educational use. Unused funds carry forward if your child remains eligible and you provide the required continuation notice.

Provider Requirements for Homeschool Services

Private tutors working with your child must:

Have a national criminal history review completed within the past two years

Not be on prohibited registries under the Education Code

Be a current/former educator at an accredited school OR hold a teaching license/instructional accreditation

Be registered to do business in Texas and comply with tax requirements

Private Schools

Understanding School-Related Definitions

Several key definitions directly impact private schools:

Campus: Defined as a building, set of buildings, or other property within a contiguous geographic area used for educational instruction

Tuition and fees: The standard amount imposed on all students by a school for teaching or instruction, including application or registration fees

Assessment instrument: A nationally norm-referenced test evaluating academic aptitude or a Chapter 39, Subchapter B test, with specific clarification that such tests must compare a child's performance to comparable children nationwide

Approval Requirements

To become an approved education service provider, private schools must:

Be accredited by an organization recognized by the Texas Private School Accreditation Commission or TEA

Demonstrate continuous operation of their campus for at least two school years preceding the approval application

Annually administer assessment instruments to participating children in grades 3-12

Be registered with the Texas Secretary of State to do business in Texas

Comply with all state tax filing, collection, and payment requirements

Provider Certifications (Under Penalty of Perjury)

Private schools must certify that they will:

Accept program money only for approved education-related expenses

Not charge program participants more than the standard rate charged to other students for the same services

Not charge participants for services or products not fully provided

Not rebate, refund, credit, or share program money with participants

Promptly return any money received in violation of program rules

Prevent individuals with disqualifying misconduct from interacting with participating children

Comply with all audit requirements

Notify the Comptroller/CEAO within 30 calendar days if no longer meeting program requirements

Assessment and Data Sharing Requirements

Private schools must administer assessment instruments that compare participating students' performance to comparable children nationwide. These tests must be given to all participating students in grades 3-12. Parents must authorize and instruct the school to provide assessment results to the CEAO by the end of the program year.

Approved Expenses and Funding

Students enrolled in approved private schools are eligible for full funding (85% of statewide average per-pupil funding), with students with disabilities potentially receiving additional amounts up to $30,000.

Approved expenses include:

Tuition and fees (including application and registration fees)

Required uniforms

Textbooks and instructional materials

Computer hardware, software, and technological devices required by the school (up to 10% of annual allocation)

Breakfast or lunch provided during the school day

The CEAO cannot make funds available until confirming enrollment at the approved private school, and enrollment verification is required before fund disbursement.

Public and Charter Schools

Eligibility and Enrollment Definitions

Children are eligible for the program if they are eligible to attend public school under Education Code §25.001 or free prekindergarten under Education Code §29.153. However, children must NOT be currently enrolled in public school or open-enrollment charter school to participate. The definition of good standing requires parents to notify the program within 30 calendar days if their child enrolls in public school, as this makes the child ineligible.

As Education Service Providers

Public and charter schools can be approved as providers if they are TEA-accredited and can prove their ability to provide services without counting participating children toward average daily attendance (ADA). They can offer classes or educational services to program participants, with fees for such services being approved expenses only if children don't count toward ADA.

Information Sharing and Confidentiality

TEA, school districts, and charter schools may share information for eligibility verification (such as enrollment status), but such information must be kept confidential and cannot be sold, distributed, or retained beyond the period necessary for eligibility determination. CEAOs must verify with TEA by October 1 and February 1 that participating children aren't enrolled in public school.

Special Education Services

Children with disabilities are defined as those eligible for school district special education under Education Code §29.003. An IEP authorization can serve as disability documentation for program prioritization purposes.

Supplemental Special Education Service (SSES) providers already approved by TEA are automatically approved for the ESA program. Educational therapy fees are approved only if the services are not provided by the public school and meet the definition of treatment provided by or at the direction of a licensed physician or licensed therapist to address academic performance.

Funding Considerations

Children with disabilities may receive additional funding up to $30,000 based on what their school district would receive under Education Code Chapter 48, beyond the base amount of 85% of estimated statewide average state and local per-pupil funding.

Staff Background Requirements

The rules define good standing for providers as preventing individuals disqualified under Education Code §22.085 (required discharge/refusal to hire) from interacting with participating children. Those in the registry under Education Code §22.092 and those with misconduct under Education Code §22.093(c)(1) are prohibited from program involvement.

Education Service Providers and Vendors

Understanding Provider Categories

The proposed rules distinguish between different types of providers:

Vendor of educational products: Providers of tangible goods such as textbooks, required uniforms, assessment instruments, curriculum, and required hardware, software, and other technological devices

Online educational course providers: Offering single, for-credit, subject-specific instructional offerings delivered synchronously or asynchronously primarily over the Internet

Various service providers, including tutors, therapists, and higher education institutions

General Approval Requirements

All providers must maintain good standing by:

Being registered with the Texas Secretary of State to do business in Texas

Having the right to transact business and comply with all state tax filing, collection, and payment requirements

Submitting a Comptroller-approved application for program approval

Required Certifications (Under Penalty of Perjury)

All providers must certify that they will:

Accept program money only for approved education-related expenses

Not charge program participants more than the standard rate charged to others for the same service/product

Not charge participants for services or products not fully provided

Not rebate, refund, credit, or share program money with participants

Promptly return money received in violation of program rules

Prevent disqualified individuals from interacting with participating children

Comply with audit requirements

Notify the Comptroller/CEAO within 30 calendar days if no longer meeting program requirements

Background Check Requirements

To maintain good standing, providers must prevent individuals required to be discharged or refused employment by school districts under specific Education Code sections from interacting with participating children. For tutors, therapists, and teaching services, a national criminal history record review must be completed within the prior two calendar years.

Specific Provider Categories and Requirements

Private Tutors/Teaching Services must:

Be current or former educators at TEA-accredited schools, TEPSAC-recognized schools, or higher education institutions, OR hold current teaching licenses or instructional accreditation

Complete national criminal history review within past two years

Not be on prohibited registries

Therapists providing educational therapies must:

Hold current, relevant professional licenses or accreditation

Complete national criminal history review within past two years

Only provide services not covered by government benefits, private insurance, or provided by public school

Higher Education Providers must prove nationally recognized postsecondary accreditation.

Private Pre-K/Kindergarten Providers must meet Education Code §29.171 requirements.

Pricing and Payment Rules

Providers cannot charge more than their standard amounts charged to non-program participants. They must refund payments for unprovided services or returned products to the CEAO, with refunds deposited back into the participating child's account. Providers cannot rebate or share program money with participants, and they cannot receive program money to pay individuals related to participating children within the third degree by consanguinity or affinity.

Suspension Procedures

Providers may be suspended for failing to maintain good standing. They receive 30-day written notice specifying required corrective actions. After 30 days, the Comptroller may remove, temporarily reinstate, or fully reinstate the provider. Decisions to remove are final and not subject to appeal, with evidence of fraud referred to appropriate authorities.

Certified Educational Assistance Organizations (CEAOs)

Selection and Registration Requirements

CEAOs must maintain good standing by being registered with the Texas Secretary of State to do business in Texas, complying with all Texas tax filing, collection, and payment requirements, and having the ability to perform services listed in Education Code §29.354.

Understanding Program Operations

CEAOs work within the program year cycle (July 1 through June 30) to manage multiple responsibilities. They must understand key definitions that affect their operations, such as total annual income for eligibility verification and good standing requirements for all participants and providers.

Cybersecurity and Privacy Obligations

CEAOs must establish and maintain cybersecurity controls and processes satisfactory to the Comptroller, implement best practices under Government Code §2054.5181, and comply with all applicable state and federal confidentiality and privacy laws, including FERPA.

Application Processing and Prioritization

CEAOs must use Comptroller-approved application forms and separate applications into required categories and subcategories for prioritization. They must understand the expanded definition of sibling (including step-siblings and foster siblings) for first priority determinations and conduct lotteries within subcategories when applications exceed available slots.

Account Management and Fund Disbursement

CEAOs receive quarterly payments from the Comptroller and must immediately deposit these funds into participating children's accounts. However, they cannot make funds available until verifying each child's continued eligibility and good standing. For private school students, they must confirm enrollment before making funds available.

The funding calculations vary based on enrollment status:

Base amount: 85% of estimated statewide average state and local funding per student in ADA

Children with disabilities: additional amount up to $30,000

Children not in approved private schools: limited to $2,000 annually

Mid-year approvals: prorated funding starting the first day of the month following approval

Ongoing Verification and Compliance

CEAOs must verify with TEA on or before October 1 and February 1 (or as requested by the Comptroller) that each participating child is not enrolled in public school. They must also ensure that refunds from providers and vendors for unprovided services or returned products are deposited back into participating children's accounts.

Managing Account Closures and Continuation

CEAOs must carry forward unused funds to the next program year if children remain eligible and parents provide a continuation notice. They must close accounts and return remaining funds to the Comptroller when children become ineligible. Applications remaining on waitlists expire at the end of each program year and require reapplication.

Implementation Timeline Changes for Families

While the overall program launch timeline remains consistent, with applications opening in early 2026 for the 2026-27 school year, several administrative timelines have accelerated. The earliest possible rule adoption date of September 21, 2025, is significantly ahead of the May 15, 2026, statutory deadline, potentially providing more time for program preparation and provider approval processes.

The accelerated contractor selection and work commencement dates suggest that the technological infrastructure and operational systems will be ready well in advance of the application period, potentially providing a smoother experience for families when applications open.

What This Means Moving Forward

The proposed rules represent a significant step forward in implementing the Texas ESA Program, transforming broad legislative language into specific, actionable procedures. For stakeholders, these rules provide the detailed framework necessary to understand exactly how the program will operate and what will be required for participation.

The 30-day public comment period offers an important opportunity for stakeholders to provide feedback before final adoption. With rule finalization potentially occurring by late September 2025, the program appears well-positioned to meet its early 2026 application launch timeline.

We encourage all stakeholder groups to review these proposed rules carefully and consider providing feedback during the public comment period. As these rules move toward final adoption, we'll continue monitoring developments and analyzing any changes that emerge from the public comment process to keep you informed of how the Texas ESA Program will serve families and educational providers across the state. Have questions about how SB2 might affect your family or educational organization? Contact us, follow us on Facebook, Instagram, YouTube, or subscribe to our newsletter for the latest updates and insights.

The ESA program represents a significant shift in Texas education. Our goal is to help families and educators make informed decisions with accurate, up-to-date information as this program develops and details continue to emerge from state officials.